How-to: Accept a Booking Payment In a Different Currency

Do you want to accept payment for your bookings in a different currency? This is easy to do and can be adjusted at the Trip level. That means you can accept different currencies on different Trips.

From within your Trip, complete these 4 steps

WARNING: You cannot change a Trip's currency, once you have begun accepting payments.

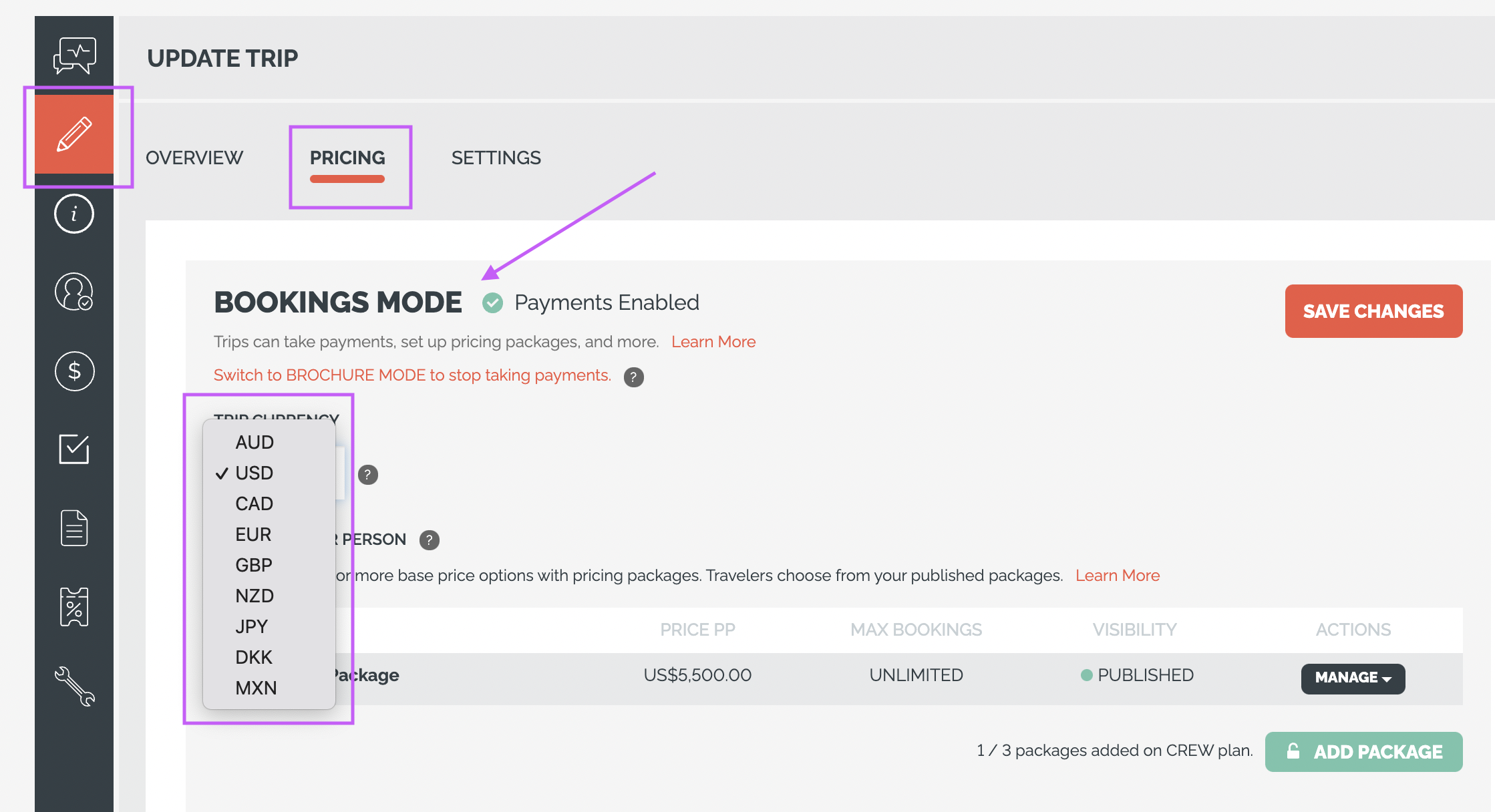

1. From your TRIP MENU, click on the UPDATE TRIP tab

2. Click on PRICING

3. Make sure you are taking payments, in BOOKINGS MODE

4. Click on the TRIP CURRENCY dropdown & select your preferred currency, from the following options (more may be added in future):

- Australian Dollars (AUD)

- United States Dollars (USD)

- Canadian Dollars (CAD)

- European Euros (EUR)

- British Pound Sterling (GBP)

- New Zealand Dollars (NZD)

- Japanese Yen (JPY)

- Danish Krone (DKK)

- Mexican Pesos (MXN)

- Indian Rupee (INR)

- and more ... need another currency, just ask us!

Foreign Transaction Fees

Deciding what currency to use involves a couple of factors.

- What currency is your bank account in?

- If you charge within YouLi in a different currency, then you will likely be paying an FX fee when the money settles into your account

- For example: if you charge in USD, but your bank account is in AUD, then Stripe (or your chosen gateway) will charge you an FX fee when settling to your AUD account.

- There may be options to defer this based on your settlement rules, but ultimately you will pay to get the money out. Some gateways offer the ability to store in USD, but then charge a percentage when you withdraw.

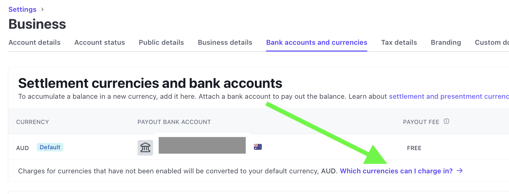

- In some countries, Stripe will allow you to settle into multi-currency accounts at your bank, to see if you have this option, go to your Balances -> Bank accounts and currencies and click on "Which currencies can I charge in?" (as shown below).

NOTE: The other currency accounts HAVE to be in a bank in your country, so you cannot connect a Wise account in another currency.

- What currency do your customers want to pay in?

- If you are selling to Americans (for example), charging in USD makes the most sense. If you charge them in AUD then they will pay an FX fee on their card and (assuming your account is in AUD) then you won't pay an FX fee on settlement

- If you are selling to Americans (for example), charging in USD makes the most sense. If you charge them in AUD then they will pay an FX fee on their card and (assuming your account is in AUD) then you won't pay an FX fee on settlement

Reducing fees

- Remember, there is no easy answer to cross-currency transactions. Unfortunately, there will always be fees somewhere. 😆

- That being said, there is usually a good way to minimize your fees, so be sure to consider all of your options.

- Additionally, YouLi offers no-booking fee/non-credit card options which may help you avoid some of these fees, if you have the right accounts set up to receive the desired currency.

I want to offer my customer to pay in THEIR currency

The main thing to remember is that when there is a currency exchange there is a fee, the question is: Who pays the fees?

As a business, you need to decide how you're going to pass those fees to your customer (or cut your margin).

There are two main options:

TRAVELER: If you charge your customer in the currency that you pay your suppliers (so you avoid FX fees), then the customer may incur a foreign transaction fee on their card/bank transfer. Then again, they might have a "FX free" traveler card, a popular option these days.

YOU: If you decide to offer the customer to pay in their currency - then you'll be incurring the FX fees. This can be a good option if you are large enough to get a better rate due to large currency conversion volume.

With YouLi, your considerations are:

- It's no problem to run each trip in a different currency (see above) - how that settles into your account depends on the connected gateway. We recommend using PayPal if you want virtual wallets to save to USD, AUD, CAD, etc and then be able to pay suppliers in that currency. In this case we recommend pricing the trip in the currency of the suppliers. So price your Italian trip in Euros and your New York trip in USD.

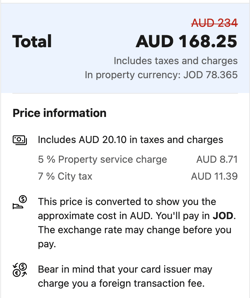

- This is typically how Booking.com works - you may see the price shown in another currency, but in the end, you pay in the currency of the hotel (the supplier). See below for more on this point.

- Enterprise customers can also connect different gateways to different trips to take advantage of the best fees for the currency being charged.

- In this way, the Traveler may incur FX fees - but those are dependent on their method of payment. In fact, you could recommend something like Wise to your customers (and get a referral fee and save them FX fees).

- If you are large enough, you might want to consider an option like Flywire - a gateway that operates as the merchant of record and handles all the FX (foreign exchange) for you. This comes with certain fees, so you'll need to consider whether you have the scale to warrant such an investment. Typically you'll need more than 50% of your revenue to be in a foreign currency otherwise, the cost of the foreign exchange far outweighs the value to your customer.

- If you choose this route, get in touch to discuss integration options.

- The reason YouLi does not show the price of the trip in another currency than it is invoiced (the way some platforms do), is because of the potential confusion. See below an example from Booking.com where the price is shown in one currency, but charged in another.

- This works well for a large, high volume platform, where the chargebacks due to confusion or cancellations are absorbed into a high volume system. For small or mid-sized businesses, if enough customers are confused about what they are paying, they might file enough chargebacks to trigger a payout freeze on your gateway account. Since this is too big a risk, we prefer to keep it super clear what the cost of the trip is.

- Of course, as the Planner launching trips on YouLi, you can provide estimated alternative pricing in other currencies using the Package Description feature. These are not dynamically priced, but of course, dynamic pricing is part of the problem - if you did have dynamic pricing, then the cost of your trip would fluctuate depending on when the traveler visited your Trip Page. Again, this works well for a large marketplace like Booking.com - but for a smaller operator, customers would not always understand or appreciate that the price is changing.

Still need help? Contact your payment gateway!

- YouLi provides the best customer experience for your Travelers, which includes accepting payments, but the gateways we integrate with (like Stripe, Square, and Cybersource) are the ones with the deepest payments expertise.

- Reach out to your gateway to get the best advice and support on fees/currency options on their platforms.

Need more help?

For more tips on pre-trip customer support join the YouLi community of travel professionals with monthly LIVE webinars and Q&A sessions.